Forms in tax booklet: Form 500, Form 500EZ, and Form IND-CR Georgia Department of Revenue 2019 Individual Income Tax 500 and 500EZ Forms and General Instructions Visit dor.georgia.gov for more information about these and other topics of interest. ON-LINE PAYMENTS The Georgia Department of Revenue accepts Visa. YOU MAY USE FORM 500EZ IF: You are not 65 or over, or blind. Your filing status is single or married filing joint and you do not claim any exemptions other than yourself or yourself and your spouse. Your income does not exceed $99,999 and you do not itemize deductions. You are a full-year Georgia resident.

What's New?

Complete, save and print your Individual Income Tax form online using your browser.

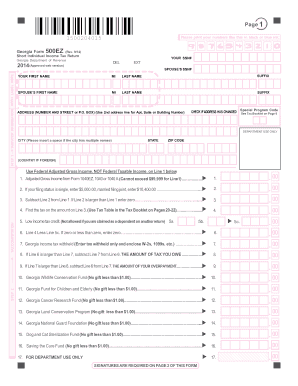

2019 - 500EZ Individual Income Tax Return

Prior Years - 2018 and earlier

IMPORTANT! To successfully complete the form, you must download and use the current version of Adobe Acrobat Reader.

To successfully complete the form, you must download and use the current version of Adobe Acrobat Reader.

- Download and save the form to your local computer. To save the file, right-click and choose save link as. Be sure and note where the file is being saved.

- Open the pdf using the current version of Adobe Acrobat Reader (download a free copy of Adobe Acrobat Reader.)

- Complete and save the form on your computer. Print the form and mail to the appropriate address on the form.

- Can I fill the forms out by hand? Yes, but forms completed electronically process faster than handwritten forms.

- Fillable forms do not work reliably with all the different browsers but they do work reliably with Adobe Acrobat Reader.

Select software vendors offer free electronic filing services to Georgia taxpayers.

See if you qualify to File for Free.

How to File Your Georgia Taxes

If you are married and file jointly with your spouse, or if you are head of household, the tax is calculated at a graduated rate and is assessed in a range of 1 to 5 percent on the first $10,000 of net taxable income (total tax on first $10,000 of net taxable income is $340) plus six percent of the excess of net taxable income that exceeds $10,000.

Disabled residents or residents over age 62 may deduct $35,000 of their retirement income. People who pay taxes to other states can receive tax refunds in Georgia, but those who pay taxes in different countries will not be credited. There is also a tax credit for people with low income (less than $19,999).

Online Tax Software: Compare Them Here

If want to prepare and file your taxes the easy way, consider using online tax software. e-File.com and Credit Karma are the most well-known software providers out there for doing your taxes online, but they each have their pros and cons.

e-File.comoffers FREE state Income Tax filing in Georgia, so make sure to check if you’re eligible. Why pay when you can file free?

- Fast Refund

- Pricing

- Ease of Use

- Accuracy

- Phone Support

- Local Support

- FREE Audit Support

Georgia Tax Forms

- Georgia Form 500-NOL - Georgia Application for Net Operating Loss Adjustment (other than corporations)

- Georgia Form 500X - Georgia Amended Individual Income Tax Return

- Georgia Form IT-511 - Georgia Individual Income Tax Instruction Booklet

- Georgia Form GA-8453 - Georgia Individual Income Tax Declaration for Electronic Filing Summary of Agreement Between Taxpayer and ERO or Paid Preparer

- Georgia Form 501X - Amended Georgia Fiduciary Income Tax Return

- Georgia Form 501 - Georgia Fiduciary Income Tax Return

- Georgia Form 500 - Georgia Individual Income Tax return (Long) (includes Schedule 3)

- Georgia Form 500EZ - Georgia Individual Income Tax Return (Short)

- Georgia Form IT-303 - Georgia Application for Extension of Time for Filing State Income Tax Returns

- Georgia IT-560 - Georgia Payment of Income Tax By Corporate Taxpayers Who Had An Extension

- Georgia Form IND-CR - Georgia Individual Credit Form

Determine Your Residency Status

The amount of your taxes depends on your residency status, so check below to see which category you fall in.

You Are a Resident of Georgia

If you keep your legal residency in Georgia, you are a resident of Georgia even if you temporarily leave the state.

As a resident of Georgia, you need to file your tax return under three different sets of circumstances: either you had to file a federal tax return, you have income that cannot be taxed by the federal system but can be taxed in Georgia, or if you earned an amount larger than Georgia’s standard deduction and individual exemptions.

Even if you income is lower than the required threshold, you may still want to file a return with Georgia, in order to claim a tax return or refund through a low-income credit. You can find out more by reading Form 511, where you’ll find instructions on how to fill out Form 500, Georgia’s personal income tax return document.

Georgia Income Tax Form 500ez

You Are a Part-Year Georgia Resident

Va Form 500ez

If you have been residing in Georgia for only part of the year, you are considered a part-year Georgia resident. You should use Form 500 and Schedule 3 (can be found on page 6 of Form 500). For more information, check the instructions in Form 511 on how to fill Form 500 and Schedule 3.

If you are a part-year resident, you can qualify for a low-income tax credit if you lived in Georgia at the end of the previous tax year (other conditions may apply as well).

You Are a Georgia Resident Who Works in a Different State

As a resident of Georgia, you must pay taxes on all income you earned, no matter the source (inside or outside the state). To avoid dual taxation, you can apply for a tax credit in Georgia. To do that, make sure you attach a copy of the tax return with the other state to your Georgia tax filing (Form 500).

If you are a full or part-year resident, you should fill out the worksheet in Form 511 (page 14) to help the authorities calculate your credit for taxes paid in a different state. If you paid taxes to more than one other state, you have to sum up all the taxes paid in other states in order to have your credit calculated. If you earned income in a different state, but that state did not tax you, you will not receive a tax credit in Georgia for that income. Also, you should keep in mind that tax credits cannot surpass Georgia’s income tax, and credits will not be granted for money earned in a different country.

You Are a Nonresident Who Works in Georgia

If you don’t legally reside in Georgia, but filed a federal return and earned more than 5% of your total salary (or at least $5,000) from a job in Georgia, then you have to file a tax return with the state of Georgia.

There are other cases when you need to file a tax return with Georgia, even if you are a nonresident. For example, if you filed a federal return, and, in Georgia, you won the lottery, made income from rent or from other entities (S-corporations, partnerships, LLC’s, trusts, estates).

Ga State Tax Form 500ez 2014 Tax Form

To file your return with Georgia, use Form 500 and include Schedule 3 (page 6 of Form 500). For more information, check the instructions in Form 511 on how to fill Form 500 and Schedule 3.